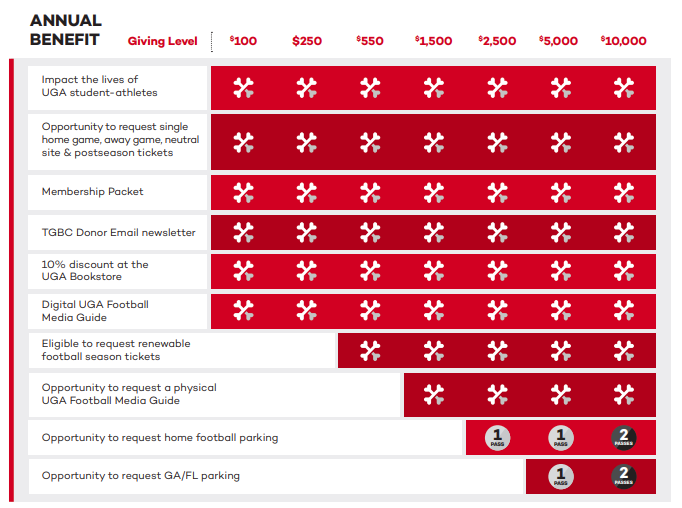

In addition to impacting the lives of our remarkable student-athletes, there are benefits associated with a contribution to the Hartman Fund.

BENEFITS GLOSSARY

If you hold more than one account with The Georgia Bulldog Club, annual giving from separate accounts will not be combined for distribution of benefits.

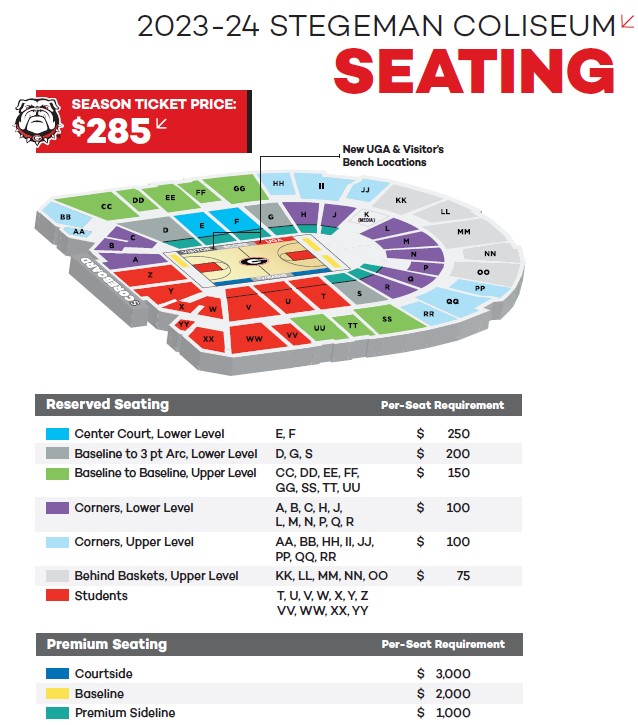

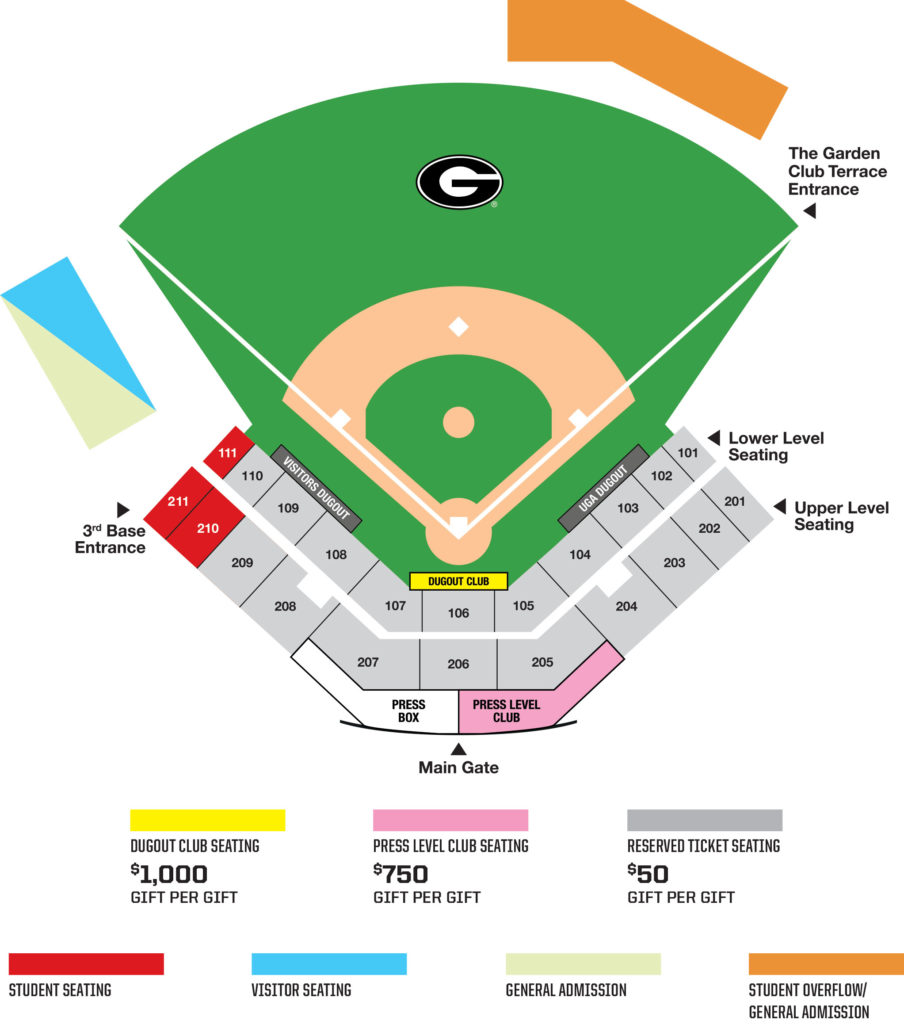

Refer to the ticket priority charts on the home page for specific game and order opportunities which are based on availability, annual gift and cumulative points. Tickets are assigned based on availability and cumulative TGBC priority points.

Includes a 2024 football schedule magnet, car decals, and an annual gift.

Stay up to date and informed as well as receive special offers through a newsletter emailed to you.

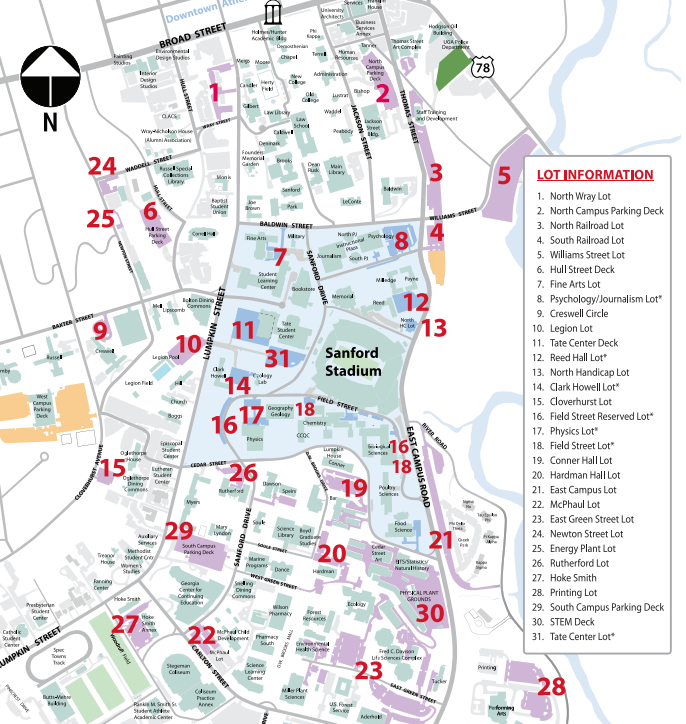

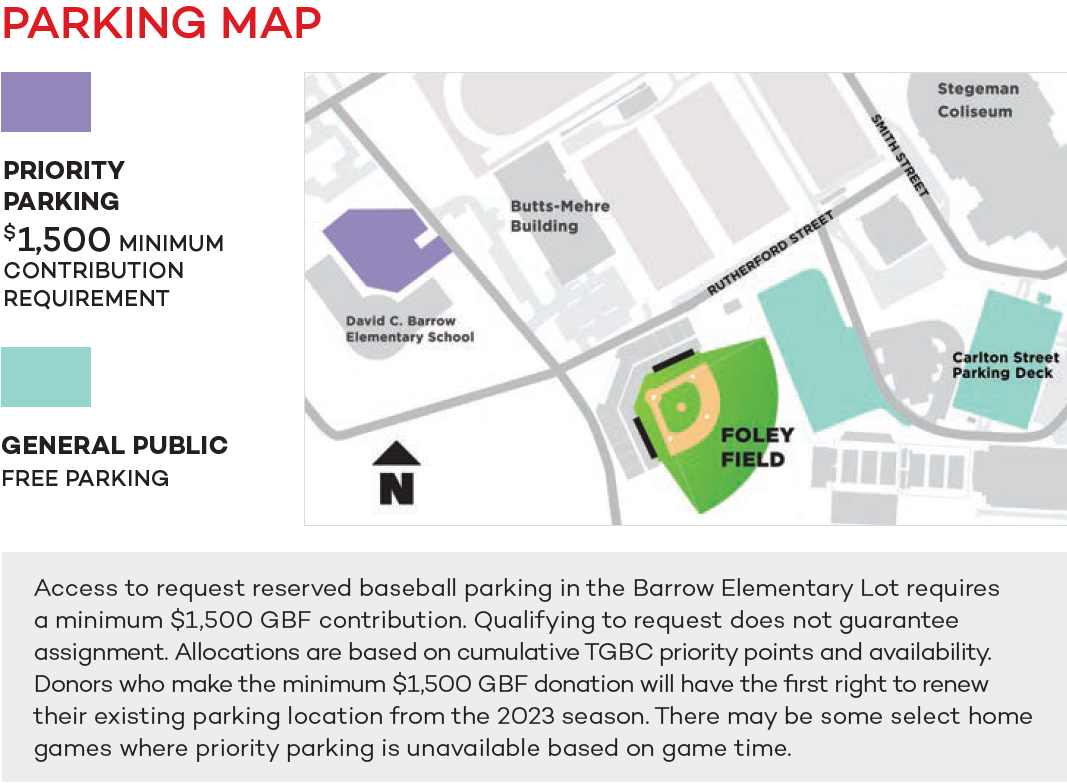

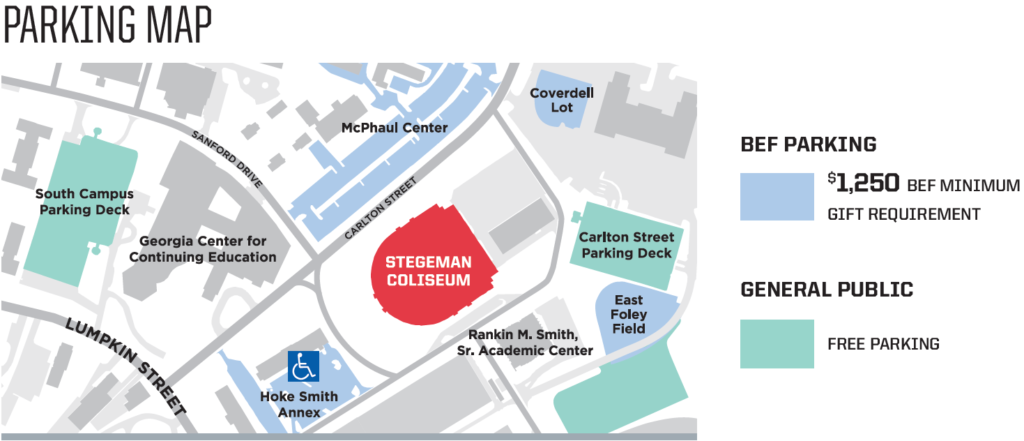

Parking is assigned based on cumulative score and availability. Any parking requests should be made on the season ticket application. There is no additional cost to obtain a parking pass. You must be a season ticket holder and contributor at the $2,500 level on the same account to qualify.

A limited number of donor parking is available at TIAA Bank Field in Jacksonville. You must be a Hartman Fund donor at a minimum of the $5,000 level and receive Georgia/Florida game tickets through the Athletic Association, to qualify. Parking is assigned based on cumulative score and availability.

The 2024 benefits can be viewed below.

Need Help?

Contact us Toll Free at 877.423.2947 or use our contact form here.