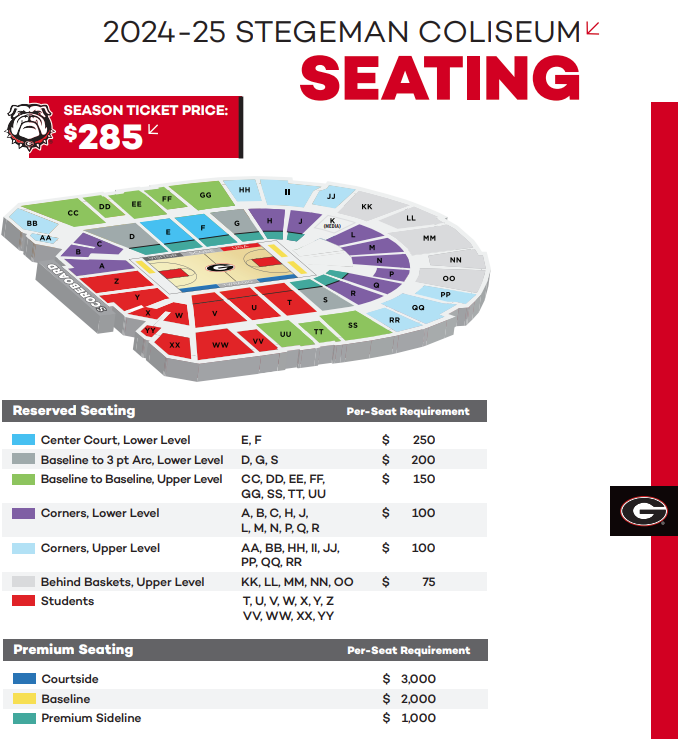

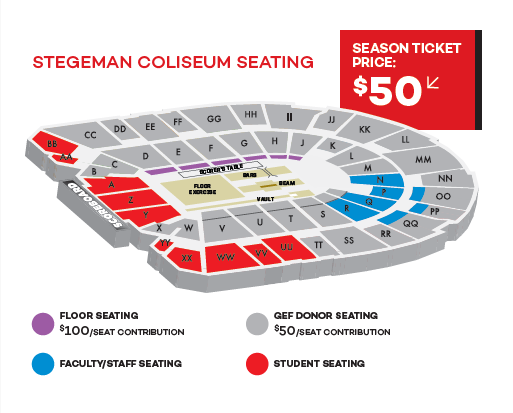

The base contribution amount to any TGBC Annual Fund is directly tied to the per-seat giving requirement associated with the purchase of season tickets, and considered non-deductible per recent tax reform.

According to section 170(I) of the U.S. Internal Revenue Code, “no deduction shall be allowed for any amount in which the taxpayer receives (directly or indirectly) as a result of paying such amount the right to purchase tickets for seating at an athletic event in an athletic stadium of such institution.”

In exchange for your gift(s) above and beyond your base, you received TGBC Priority Points. If section 170(I) does not apply, then we believe these priority points have nominal value. In all cases, please retain this receipt and consult your tax advisor to determine your proper charitable contribution deduction. If you have any questions or if we can be of any help to you in regards to your ongoing involvement with UGA Athletics, please contact the TGBC office at 877-423-2947.