You can become a member of The Georgia Bulldog Club (TGBC) by donating a minimum of $100 to the Hartman Fund. In addition, there are also a variety of other ways to join/support UGA Athletics by making contributions to the Basketball Enhancement Fund, the Gymnastics Endowment Fund, the Georgia Baseball Fund, the Magill Society, the Endowment Program and via sport-specific giving opportunities.

Private support is essential to the success of UGA student-athletes and the UGA Athletic Association (UGAAA). UGAAA receives no financial assistance from the state of Georgia. It is a self-funded entity, solely dependent upon self-generated revenues to operate and provide student-athlete scholarships, build world-class athletic facilities and ensure UGA’s tradition of athletic excellence continues to grow.

The best way to increase your priority point ranking is to join the Magill Society, which awards bonus priority points for commitments of $25,000 or greater that are made payable over a 5-year period of time. Increasing your support to the Hartman Fund is also a great way to increase your priority point total and improve your ranking. Lastly, referring new TGBC and/or Magill Society members is another way to help grow the base of support towards UGA Athletics while also increasing your priority point total and ranking amongst our donors.

Fans who are interested in securing new football season tickets must complete two steps in order to request season tickets. First, you must make a qualifying Hartman Fund donation by February 15 that meets or exceeds the per-seat giving requirement associated with the season tickets that you are interested in securing*. A full map of Sanford Stadium on the Sanford Stadium Seating page has the corresponding minimum per-seat giving requirements associated with season tickets in each section. Second, you must submit a season ticket application with payment by March 31.

*Making the per-seat minimum contribution does not guarantee that you will have the opportunity to secure new seats in a desired section. Determining the priority cutoff for new season ticket acquisitions in various sections in Sanford Stadium is difficult to project as it based on attrition and donor demand.

Donors can relocate your seats within Sanford Stadium by opting into the optional seat and parking selection process on your season ticket application. The selection process takes place in May. All donors opted into the process will receive a selection time based on cumulative TGBC priority points. If your selection time arrives and you see seats you want to move into, you can select them at that time and drop your previous seats. If you do not see any seats/parking you want to move into at your selection time, you can retain your same seats from the previous year.

Yes, if you are unable to relocate your seats, your seat location will remain the same, unless otherwise indicated. With an average renewal rate of nearly 90% each year, the relocation of seats can be very difficult.

Priority point cutoffs for each section can change from year-to-year. Unfortunately, it is impossible for TGBC to predict what the priority point cutoff will be for each section. We can however provide some historical perspective based on previous year cutoffs. Please feel free to contact our office and we will gladly share historical cutoffs with you and provide guestimates for the upcoming year.

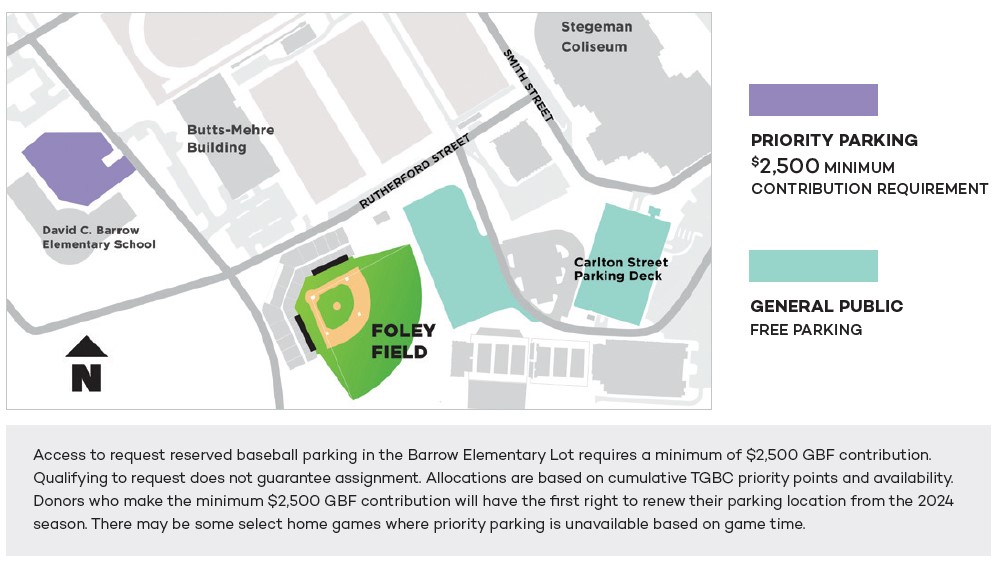

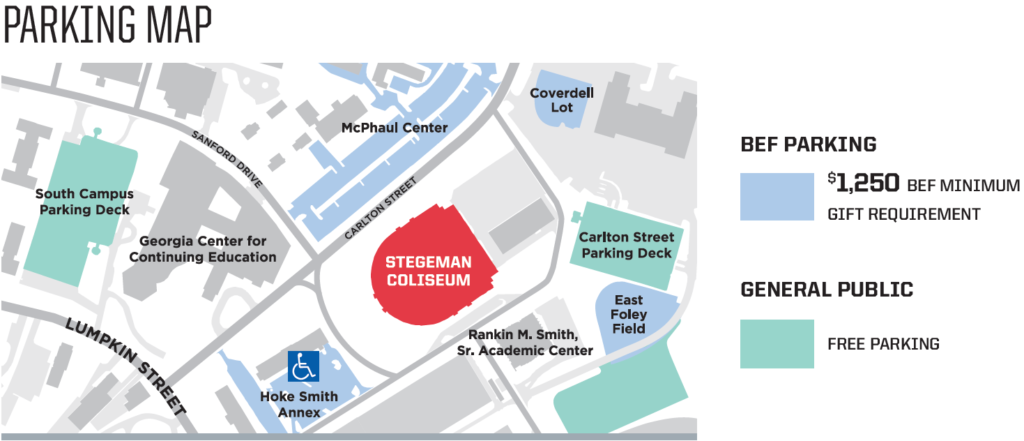

Parking allocations are handled similarly to season tickets. Hartman Fund donors who contribute $2,500 or more and have purchased football season tickets will receive one complimentary season parking pass. Parking selections can be made during the online football seat and parking selection process in Summer 2021.

Away game ticket locations are allocated based on priority points whereas the number of tickets that a donor is eligible to request is based on either your Hartman Fund donation or your commitment level to the Magill Society. Please see the Hartman Fund brochure for a full breakdown on our away game quantity cutoffs and priority point requirements.

An account, including the associated priority points and season tickets, may be transferred to a spouse only at the time of death. An account, including the associated priority points, parking, and season tickets can also be transferred one-time if one is the member of the Silver Circle.

Need Help?

Contact us Toll Free at 877.423.2947 or use our contact form here.